. . . LAND ROVER OVERLAND EXPEDITION

|

#2 - Curb Rates and

Hyperinflation (Victoria Falls, ZIMBABWE) - Arriving at the spanking new airport terminal in Zimbabwe I lectured my two traveling companions, �Be sure to use the cash machines to get money here, because Zambia, the neighboring country to the north, is still in the stone age � you don�t want to have to exchange some of your precious US dollar cash.� Little did I know how topsy turvy things had become over the past two years. Hunting down the only working cash machine at the airport I withdrew 2,500 Zimbabwe dollars. In the derelict domestic terminal the exchange rate was 62 Zim/$1, I assumed the bank would ding me down a couple points to 55/1 � even so, paying a premium to access cash directly from the bank account was still better than exchanging the precious cash stash. But I was surprised the next day after we�d crossed the border and checked into a hostel in Livingstone, Zambia (the sister city on the opposite side of the river from Victoria Falls). During our walk downtown we found brand new Barklay�s Bank cash machines (two years ago the currency was tumbling � and the black market was booming). What was going on? Turns out that Zambia�s privatization of it�s primary foreign income generator, the northern copper mines, had buffed up it�s reputation with the IMF and unlocked stabilization loans. Increased foreign revenue, bilateral donor subsidization of the government�s perennial deficit, customer confidence � all of these things contributed to a reasonably stable foreign exchange. At 3550 Kwacha/$1, the local currency had taken a beating over the years. But the most important thing was that it was now stable. Thus the functioning cash machines. The contrast across the river was stark. On the very day that we�d flown in, the increasingly unpopular Mugabe government had decided to raise the price of petrol by 70% - overnight. Far from the civilized bastion of competence that I�d visited in 1999, Zimbabwe had tumbled into economic freefall. The decision to seize white-owned farms in order to gain political support had been the final straw for an economy that had labored for two decades under ineptitude and outright thievery by top government officials. Without the crucial foreign currency provided by the sale of tobacco and other cash crops, the central bank was unable to prop up the exchange rate. And the unfortunate decision to finance the deficit by printing lots of new Zim dollars fuelled the meltdown.

�Boss, you need Zim dollars?� �How much?� �120 Zim dollars for one US dollar.� �I�ll take $40 worth!� I walked away from the transaction with bulging pockets full of bills. Typically in a hyperinflationary environment the government is in denial and large denomination bills don�t exist � so a hundred bucks will get you a massive pile of 100 Zim bills. Kinda cool to whip off tips, but darn unsafe with pickpockets around. It was a bit painful to realize that the 2,500 Zim I had withdrawn from the bank a few days earlier had cost me about $40. At 120/1 I got 4,800 Zim for $40 � and I hadn�t even bargained. Over the next few days the rate increased daily. From 120/1 to 130/1 and then to 135/1. In a country gripped by hyperinflation the strategy is always to exchange on the curb (counting the money carefully to look for counterfeit bills) and pay in local currency. Two bedroom cottages in the municipal campsite cost $7US per person � or 350 Zim. It doesn�t take long to do that math, at the curb rate you are actually paying only $3! Saavy entrepreneurs adjust for the sliding exchange. A recent study by the IMF found that economies stuck in hyperinflation pay a hidden tax of 5-10% in lost productivity � mostly the result of business owners scrambling to hedge their inventories or receivables. In Zimbabwe most hostels and adrenaline activity companies now charge in $US, a double safety because not only do they hedge their receipts but they are also able to bill credit cards at a sub-par curb rate (100/1 instead of 130/1). But the bargains are to be found at larger institutions or government run establishments. Pegged to an artificially low rate, they are unable to increase their prices to reflect the actual curb rate, and so the prices are ridiculously cheap.

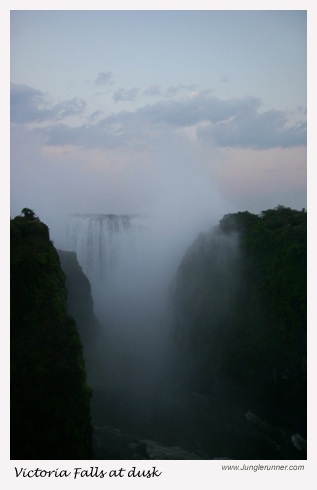

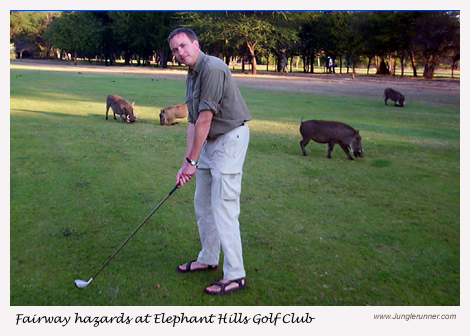

The Elephant Hills Golf Club at the Intercontinental Hotel in Victoria Falls is a perfect example of an artificially low exchange rate. It is the only credible golf course in the area � a decent 18 hole track whose major attraction is the large number of varied game that wander freely through the course (Local Rule 4; warthog damage may be treated as Ground Under Repair). Walking mere yards away from waterbuck, warthog, impala, baboons, crocodile, and the occasional elephant, makes your score rather irrelevant � it�s more like a private game walk than a round of golf. Knowing the course from previous trips, I made a beeline for the hotel to get a round in before Sally and Jody arrived. What luck. The Intercontinental was changing guest dollars at 65/1, which meant they had to keep their Zim prices low. A classic arbitrage opportunity � I traded my dollars on the curb and paid half of what the hotel guests were charged! $3 for club rental, $7 for 18 holes (including caddy), and $2 for a double decker ham & cheese sandwich with chips and a Coke served in the clubhouse at the turn. Playing the course is a treat at any time, but doing it at half price made the round even sweeter. At the end of the round I asked the caddy which currency he�d prefer for his tip � Beki said, �$US of course�. Giving a $10 tip in cash is a natural hedge and the only safe savings. Another common tactic used by folks who are paid once a month and have no access to hard currency is to go immediately to the supermarket and spend their entire paycheck on consumables. By mid-month when the currency has slid yet again, they will be bartering soap for fresh meat and maize. Being in Zimbabwe was bittersweet. Victoria Falls was breathtaking as ever, and walking through the Falls park is always a treat (rent the $1 raincoats because the mist pelts you from all over � guaranteed complete soaking). But witnessing the sad collapse of one of the finest economies in Africa is painful. I hope against hope that the 2002 elections will usher in a credible new government, and restore my confidence in airport cash machines.

|

All rights reserved

When

we returned across the Zambezi river to re-visit the Zimbabwe side we

eschewed the banks, opting for the much more accurate gauge of actual

economic level, the curb rate. A euphemism for the black market, economists

have long used the curb rate to assess the real exchange rate in countries

suffering from hyperinflation. Curb rate takes its name from the location

where the transactions take place, the roadside curb. �Friend, my friend,

you want to change money?� Where there are black market dealers, there

is hyperinflation. It�s a simple matter of profit margins. Shopkeepers

desperate to keep stock on their shelves and unable to get US dollars

from the central bank begin paying a premium to black marketers. In turn,

the black market dealers are able to offer a sweeter rate than the official

foreign exchange offices. Prices paid for dollars continue to rise until

demand is met, the wider the gap between the official and curb rate,

the worse the hyperinflation is. Where foreign exchange prices are relatively

stable there is not enough room for black market traders to make a profit,

so the curb boys disappear.

When

we returned across the Zambezi river to re-visit the Zimbabwe side we

eschewed the banks, opting for the much more accurate gauge of actual

economic level, the curb rate. A euphemism for the black market, economists

have long used the curb rate to assess the real exchange rate in countries

suffering from hyperinflation. Curb rate takes its name from the location

where the transactions take place, the roadside curb. �Friend, my friend,

you want to change money?� Where there are black market dealers, there

is hyperinflation. It�s a simple matter of profit margins. Shopkeepers

desperate to keep stock on their shelves and unable to get US dollars

from the central bank begin paying a premium to black marketers. In turn,

the black market dealers are able to offer a sweeter rate than the official

foreign exchange offices. Prices paid for dollars continue to rise until

demand is met, the wider the gap between the official and curb rate,

the worse the hyperinflation is. Where foreign exchange prices are relatively

stable there is not enough room for black market traders to make a profit,

so the curb boys disappear.